Spending Analyses:

Debt, Deficit Analyses:

Numbers — Charts:

| Tweet | | Contact | Follow @chrischantrill |

Debt and Deficit Facts

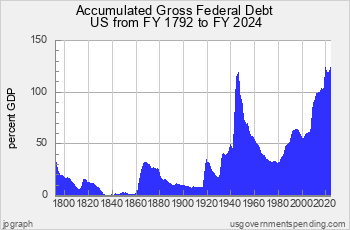

Right now the Gross Federal Debt is $37,889,756,572,760.44.

At the end of

FY 2025 the debt was $37.64 trillion,

or 128.3% GDP.

The previous highest federal debt in US history was 119.0% GDP in 1946 just after World War II.

At the end of

FY 2025 the federal deficit was $2,031 billion,

or 6.9% GDP.

The highest federal deficit in US history was 29.0% GDP in 1943 in World War II.

a usgovernmentdebt.us briefing:

US National Debt and Deficit History

Suggested Video: US Defense Spending

Top Debt Requests:

Find DEFICIT stats and history.

US BUDGET overview and pie chart.

Find NATIONAL DEBT today.

See FEDERAL BUDGET breakdown and estimated vs. actual.

Check STATE debt: CA NY TX FL and compare.

See DEBT ANALYSIS briefing.

See DEBT HISTORY briefing.

Take a COURSE at Spending 101.

Make your own CUSTOM CHART.

Debt Data Sources

Debt data is from official government sources.

- Federal debt data since 1962 comes from the president’s budget.

- Federal debt for 1940-1961 comes from the president’s budget.

- Federal debt for 1914-1939 comes from the

US Treasury

and St. Louis Fed.

- Federal debt before 1914 comes from the

US Treasury

- All other debt data comes from the US Census Bureau.

Gross Domestic Product data comes from US Bureau of Economic Analysis and measuringworth.com.

Detailed table of debt data sources here.

Federal debt data begins in 1792.

State and local debt data begins in 1820.

State and local debt data for individual states begins in 1957.

Gross Federal Debt

| Debt Now: | $37,889,756,572,760.44 | Debt 2/2020: | $23,409,959,150,243.63 |

Site Search

Spending 101

Take a course in government spending:

Spending |

Federal Debt |

Revenue

Defense |

Welfare |

Healthcare |

Education

Debt History |

Entitlements |

Deficits

State Spending |

State Taxes |

State Debt

It’s free!

Win Cash for Bugs

File a valid bug report and get a $5 Amazon Gift Certificate.

Get the Books

Price: $0.99 Or download for free. |

From usgovernment spending.com Price: $1.99 |

Life after liberalism Price: $0.99 Or download for free. |

Data Sources for 2026:

GDP, GO: GDP, GO Sources

Federal: Fed. Budget: Hist. Tables 3.2, 5.1, 7.1

State and Local: State and Local Gov. Finances

'Guesstimated' by projecting the latest change in reported spending forward to future years

> data sources for other years

> data update schedule.

Blog

CBO Long Term Budget Outlook for 2025

On March 27, 2025 the Congressional Budget Office released its annual Long Term Budget Outlook for 2025, which projects federal spending and revenue out to 2055. As before, the data for the CBO study shows that federal health-care programs and interest costs will eat the budget, with federal spending exceeding 25 percent GDP by the 2040s while federal revenue stays a little over 19 percent GDP.

UsGovernmentspending.com has updated its chart of the CBO Long Term Budget Outlook here. You can download the data and also view CBO Long Term Budget Outlooks going back to 1999.

On November 22, 2025 usgovernmentspending.com updated FY2025 state revenue with quarterly tax data released by the US Ce ...

The US Bureau of Economic Analysis (BEA) released its Gross State Product (GSP) data for 2024 on March 29, 2025.Usgovernmen ...

> blog

Budget News

President’s FY 2025 Budget Release Scheduled for March 11

Although the FY 2024 appropriations process is not yet resolved

Biden to Release Budget March 9

will press McCarthy On Default Risk - Bloomberg

Biden to Release 2023 Budget Request on March 28

how the administration expects to spend money for priorities including aid to Ukraine and the continuing effort to fight the coronavirus pandemic, as well as legislative proposals such as increased funding for community policing programs, cancer research, and mental health education.

> archive

Spend Links

us numbers • us budget • custom chart • deficit/gdp • spend/gdp • debt/gdp • us gdp • us real gdp • state gdp • breakdown • federal • state • local • 2024 • 2025 • 2026 • california • texas

- Federal gross debt

- Federal gross debt - Local gross debt

- Local gross debt - State gross debt

- State gross debt